An Real World Example Of Marginal Propensity To Consume

The marginal propensity to consume (MPC) is an economic concept that measures the change in consumer spending due to a change in disposable income. In simple terms, it is the percent of a household’s additional income that is spent on goods and services. An example of this concept can be seen in a family that receives a tax refund. If the family receives an extra $1,000 and spends $800 of that amount, then the marginal propensity to consume for this family is 0.8.

What is Marginal Propensity To Consume?

Marginal Propensity to Consume (MPC) is an economic term which describes the rate at which a consumer’s spending increases when their income rises. It is a measure of how much of the extra income is spent, as opposed to saved. It is a concept used to analyze the relationship between an increase in income and the corresponding increase in consumption.

MPC helps economists understand how an increase in income affects consumer spending patterns and the overall economy. It is an important tool for understanding how an increase in consumer spending can lead to an increase in economic growth. Economists use it to assess the impact of tax cuts, government spending, and other economic policies.

MPC can be calculated using a formula which takes into account the percentage of the increase in income which is spent, and the percentage of the increase in consumption which is saved. This formula can be used to determine how much of an increase in income will be spent, and how much will be saved.

MPC is an important economic concept which can help us understand the relationship between income and consumption. It can also be used to measure the impact of economic policies and to assess how an increase in consumer spending can lead to economic growth. Understanding the concept of MPC and how it affects the economy can be beneficial to both consumers and policy makers.

How Consumer Behavior is Influenced by Marginal Propensity To Consume

Understanding consumer behavior is critical for businesses to maximize profits and minimize costs. One key element of consumer behavior that can have a major impact on businesses is the marginal propensity to consume (MPC). The MPC is the rate at which a consumer increases their spending when faced with an increase in their income. As income increases, consumers have more money to spend, and the MPC helps to measure how much of that extra money is spent.

Understanding the MPC can help businesses better understand how their products and services will be impacted by changes in consumer income. For example, a business may want to increase the prices of its products and services if the MPC is low, as consumers will not be as likely to purchase them. On the other hand, if the MPC is high, businesses may want to reduce prices in order to make their products and services more attractive to consumers.

By looking at the MPC and other factors, businesses can better predict consumer behavior and adjust their strategies accordingly. For example, businesses that increase their prices when the MPC is low may find that their sales decrease, while businesses that reduce their prices when the MPC is high may find that their sales increase. This information can help businesses make the right decisions to maximize profits.

Understanding the MPC can also help businesses make decisions about how to spend their marketing budgets. For example, businesses may want to focus their marketing efforts on consumers with higher MPCs, as they are more likely to purchase their products and services.

In conclusion, the marginal propensity to consume is an important factor that can have a major impact on consumer behavior. By understanding the MPC, businesses can make better decisions about pricing, marketing, and other strategies in order to maximize profits and minimize costs.

Measuring the Marginal Propensity To Consume

(MPC) is an important concept to understand in economics.

The Marginal Propensity to Consume (MPC) is a measure of how much of a consumer’s income is spent on goods and services. It is a fundamental concept in economics and is used to predict consumer behavior and to analyze the impact of fiscal policy on an economy. To better understand the concept of MPC, let’s look at a real-world example.

Imagine a consumer who has a total income of $1,000. If they spend $500 of that income on goods and services, their MPC ratio would be 0.5, or 50%. This number can be used to estimate how economic policies will affect consumer spending habits. For example, if the consumer’s income were to increase by $100, their MPC ratio would tell us how much of that extra income they would be likely to spend on goods and services.

The Marginal Propensity to Consume (MPC) is an important concept in economics, and understanding how it works can help us understand how economic policies affect consumer behavior. By looking at a real-world example, we can see just how powerful this concept can be. By measuring the MPC of a consumer, we can better predict their spending habits and the impact of fiscal policy on the economy.

:max_bytes(150000):strip_icc()/Marginal-propensity-to-consume-4193236-ecb7990f8dc2429692274122652df5d6.jpg)

Factors Affecting Marginal Propensity To Consume

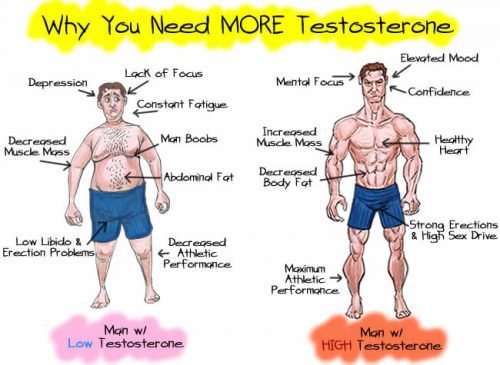

There are a number of factors that can affect an individual’s marginal propensity to consume (MPC), and understanding these influences can be essential to making sound economic decisions. The MPC is a measure of the amount of additional consumption an individual will make for each additional unit of income. To make an informed decision, it is important to consider the factors that can impact an individual’s MPC.

One of the most important factors influencing an individual’s MPC is their current level of income. Generally, the higher the level of income, the higher the MPC. This is because those with higher incomes are more likely to have the means to purchase more goods or services with each additional unit of income.

Another factor to consider is the individual’s level of savings. Those with high savings rates will have a lower MPC than those with lower savings rates, as they are more likely to put the additional income towards savings rather than consumption.

In addition, the availability of goods and services in the market can also have an effect on an individual’s MPC. If goods and services are scarce, individuals may be more likely to spend their additional income on goods and services that may be difficult to replace. On the other hand, if goods and services are abundant, individuals may be more likely to save their additional income.

Finally, the amount of debt that an individual has can also have an impact on their MPC. Those with high levels of debt may have a lower MPC, as they are more likely to use any additional income to pay off their debt rather than spend it on consumption.

Understanding the various factors that can influence an individual’s marginal propensity to consume can be essential to making sound economic decisions. By considering these factors, individuals can make decisions that are in their best financial interests.

Impact of Marginal Propensity To Consume on the Economy

The Marginal Propensity To Consume (MPC) is one of the key economic indicators that help assess the strength of a nation’s economy. It measures the proportion of disposable income that a household spends for consumption, and it is a key factor influencing the level of economic activity in a country. It can be used to determine how much of an impact a given change in disposable income can have on the level of economic activity. In this article, we will explore how the MPC can be used to analyze the impact of changes in disposable income on the economy and provide a real-world example of how the MPC affects economic growth.

In the simplest terms, the MPC is the ratio of the amount of additional consumption that results from a given increase in disposable income. The higher the MPC, the more economic activity that will be generated from a given increase in disposable income. The MPC can be used to measure the impact of changes in consumer spending on the macroeconomic environment. For example, if the MPC of an economy is high, then an increase in disposable income will result in a significant increase in economic activity.

In the real world, the MPC can be used to analyze the effect of changes in disposable income on economic growth. For example, if the MPC of an economy is high, then an increase in disposable income will result in a significant increase in economic activity. This can occur if the increase in disposable income leads to an increase in the demand for goods and services, which in turn leads to an increase in production and incomes. Similarly, if the MPC is low, then an increase in disposable income will not have a significant effect on economic growth.

By understanding the impact of the MPC on the economy, economists can make better decisions regarding fiscal and monetary policy. For example, if the MPC of an economy is low, then a tax cut may not have a significant effect on economic growth. In contrast, if the MPC is high, then a tax cut may result in an increase in economic activity.

Overall, the MPC is an important economic indicator that can be used to analyze the effect of changes in disposable income on economic growth. By understanding the impact of the MPC on the economy, economists can make better decisions regarding fiscal and monetary policy. Moreover, the MPC can also be used to assess the potential impact of changes in consumer spending on the macroeconomic environment.

Conclusion

Marginal propensity to consume (MPC) is a key economic concept that helps to explain how people and businesses make decisions about spending and saving. It is important for economists to understand how the marginal propensity to consume affects the overall economy so they can make better predictions about the future. In this article, we have discussed the concept of marginal propensity to consume and provided a real-world example of how it works. We also discussed how consumer behavior can be affected by changes in marginal propensity to consume. Finally, we examined how changes in MPC affect economic growth. By understanding how the marginal propensity to consume works, economists and analysts can make better predictions about the future of the economy.

FAQs About the An Real World Example Of Marginal Propensity To Consume

Q1: What is an example of Marginal Propensity to Consume?

A1: An example of Marginal Propensity to Consume is when a consumer spends an extra $100 in disposable income on consumer goods, such as groceries, clothes, or entertainment.

Q2: How does Marginal Propensity to Consume work in the real world?

A2: In the real world, Marginal Propensity to Consume (MPC) is the measure of the percentage of extra income that is spent on consumer goods and services. This can be calculated by taking the change in consumption divided by the change in income.

Q3: How can Marginal Propensity to Consume be used to make financial decisions?

A3: Marginal Propensity to Consume can be used to inform financial decisions by estimating the amount of economic growth that a consumer’s increased spending could generate. This information can be used to set fiscal policies, such as taxation, that could encourage or discourage consumer spending.

Conclusion

The marginal propensity to consume is a key concept in macroeconomics, and an important factor in understanding consumer behavior. An example of this concept in the real world can be seen in the spending habits of people who receive a one-time windfall such as a bonus from their job or an inheritance. In most cases, when people receive a sudden influx of money, they will spend some of it immediately and save the rest. This behavior is an example of the marginal propensity to consume, as most people will not spend their entire windfall in one go, but instead decide to save some for future purchases.