Real Options Managing Strategic Investment In An Uncertain World

Real Options Managing Strategic Investment in an Uncertain World is a comprehensive guide to the fundamentals of real options and its applications to the strategic decision-making process. It offers a practical framework that can be used to assess and design investment strategies in today’s uncertain and dynamic environment. The book provides a detailed review of the fundamentals of real options and how to incorporate them into the decision-making process. It includes a comprehensive glossary of related terms, as well as case studies and examples of how real options can be used in different industries. The book also covers the basics of project management and how to use real options to maximize the return on investment. This book is essential reading for anyone seeking to better understand the principles of real options and how to use them in their strategic decision-making.

What Are Real Options?

Real options are a form of strategic investment that allow for flexibility and adaptation in times of uncertainty. It is a way of evaluating potential investments using a risk/return framework that takes into account the unpredictability of the future. Real options provide the opportunity to invest in a project and then adjust the investment strategy if the project is not working out as expected. This allows businesses to make decisions about which investments to pursue and which to avoid, based on the potential payoffs and the risk associated with each option. Real options provide a risk management framework that can help businesses to adapt to changing conditions and maximize the potential returns from their investments. By using real options, businesses can better evaluate the potential risks and rewards of each investment and make more informed decisions about which investments to pursue.

The Strategic Benefits of Real Options in Uncertain Times

In today’s volatile and uncertain times, businesses need to be agile and have the flexibility to make strategic investments that can be easily adjusted and adapted to changing conditions. Real Options provide companies with a powerful and versatile tool for managing strategic investments in an uncertain world. Real Options offer businesses the ability to invest with greater confidence and reduce the risk of costly mistakes.

Real Options allow companies to take advantage of opportunities when they arise and to adjust strategies when conditions change. They allow businesses to reduce risk by leveraging the volatility of markets and the uncertainty of outcomes. By using Real Options, businesses can benefit from the potential upside of a potential investment while limiting the downside risk.

Real Options provide businesses with the flexibility to make strategic investments without committing to a set course of action. They allow a company to respond to changing market conditions and make decisions based on the current values of their investments. Real Options can be used to invest in new products, services, or new markets, allowing businesses to diversify their investments and reduce their overall risk exposure.

Real Options provide businesses with the ability to manage their investments in an uncertain world. They offer businesses a powerful decision-making tool and the flexibility to make strategic investments in a changing environment. With Real Options, businesses can reduce their risk exposure and take advantage of opportunities that may arise.

Assessing Risk in Real Options

Real options, or options that are based on real-world investments, represent a form of strategic investment that can be used to manage risk in an uncertain world. Real options are often used to hedge against potential losses, by providing the investor with the ability to reallocate resources or delay an investment if the market turns against them. However, assessing the risk associated with these investments can be a challenge.

In order to effectively assess the risk associated with real options, investors must understand the various factors that can affect the value of the option. These factors include the time value of money, the volatility of the underlying asset, and the expected return on the option. Additionally, investors must consider the cost of capital, the cost of capitalization, and the liquidity of the option. By understanding the interplay between these factors, investors can make informed decisions about the potential risk associated with real options.

Investors must also consider the impact of macroeconomic forces such as inflation, interest rate fluctuations, and exchange rate movements when assessing the risk associated with real options. Additionally, the specific characteristics of the underlying asset, such as the size of the market, the availability of liquidity, and the liquidity of the option must be taken into account. These factors can significantly influence the risk associated with real options and must be carefully evaluated before making an investment decision.

Ultimately, the best way to assess the risk associated with real options is to conduct a thorough analysis of the underlying asset, the macroeconomic environment, and the specific characteristics of the option. By taking the time to understand the various factors that can impact the value of the option, investors can make informed decisions about the potential risk associated with real options and can use this knowledge to successfully manage their strategic investments in an uncertain world.

Financial Valuation of Real Options

Real options valuation is a key part of managing strategic investments in an uncertain world. Real options are financial instruments that provide the holder with the right, but not the obligation, to choose whether to exercise the option or not. The value of a real option is based on the expected future cash flows that may result from exercising the option. By using real options, companies can hedge risks, increase financial flexibility, and make better informed decisions in the face of uncertainty.

Real options valuation involves analyzing the potential risks and rewards associated with a given investment. A careful assessment of the current and expected future conditions is necessary to determine the appropriate level of risk to take on and the potential returns. In this context, a financial analyst must weigh the cost of the option against the potential benefits of the investment. For example, if the expected future cash flows are higher than the cost of the option, it may be worthwhile to exercise the option.

Real options provide companies with the flexibility to adjust their strategies in response to changing market conditions. By evaluating the potential risks and benefits associated with an investment, a company can make better informed decisions and maximize its return on investment. Therefore, real options are an important tool for managing strategic investments in an uncertain world.

Creating and Implementing an Investment Strategy with Real Options

In the current climate of economic uncertainty, companies need to think carefully about strategic investment decisions. Real options provide a way to manage investments and strategically position companies for growth. Real options are financial instruments that give the holder the right, but not the obligation, to buy or sell an asset at an agreed upon price before a certain date. By using real options, companies can make investments in assets while protecting them against losses due to market volatility.

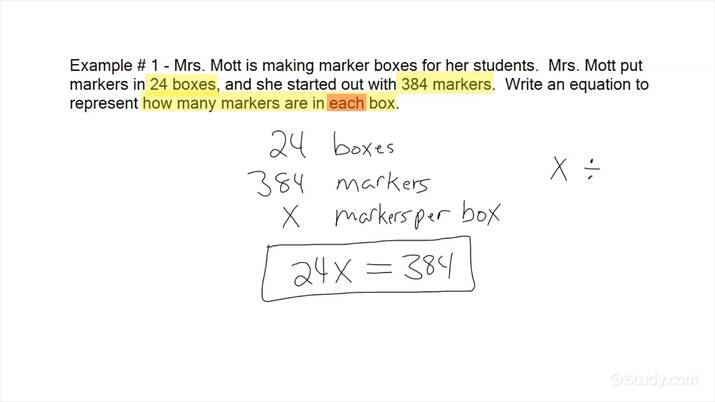

Real options analysis (ROA) is a method of evaluating the potential return of an investment while also taking into account the risks associated with the investment. ROA provides a more complete view of the investment opportunity by taking into account the cost of capital, the time value of money, expected returns, and the uncertainty of the investment environment. It also allows investors to adjust their investments in response to changing market conditions.

Real options can help companies manage their investments in a way that is more flexible and tailored to their specific needs. Companies can use real options to hedge against losses due to market volatility or to gain exposure to new markets. By using real options, companies can make informed decisions about their investments and can adjust them quickly in response to changing market conditions. With the right strategy in place, businesses can benefit from the potential for increased profits while minimizing their risk.

Conclusion

The world of business is unpredictable and the ability to make strategic investments and manage real options is an integral part of a successful business. This article has explored the concept of real options, the importance of managing and optimizing them, and the different strategies that can be employed to maximize returns and minimize risks. It is important to note that the success of any strategy will depend on the prevailing market conditions and the particular situation of the business. As such, businesses should always be prepared to adjust their strategies depending on the situation. Real options can help businesses to make successful investments and manage risks in an uncertain world.

FAQs About the Real Options Managing Strategic Investment In An Uncertain World

1. What is real options managing strategic investment in an uncertain world?

Real options managing strategic investment in an uncertain world is an approach to corporate strategy that uses techniques from real options theory to make decisions about investing in projects with uncertain outcomes. It allows managers to make decisions in the face of risk and uncertainty and to respond quickly to changing market conditions.

2. What are the benefits of using real options managing strategic investment in an uncertain world?

The main benefit of using real options managing strategic investment in an uncertain world is that it provides managers with a more flexible approach to decision-making. By using real options techniques, managers can evaluate future investment opportunities in light of the uncertainties associated with them and make decisions that are better informed and more likely to yield successful results.

3. What types of decisions are suitable for real options managing strategic investment in an uncertain world?

Real options managing strategic investment in an uncertain world can be used to make decisions about a wide range of investments, including capital investments, mergers and acquisitions, and joint ventures. It can also be used to evaluate the potential returns from research and development projects, as well as to identify new opportunities for growth.

Conclusion

Real options managing strategic investment in an uncertain world is a powerful tool for businesses that need to make informed decisions about their investments. It provides a framework for evaluating investment decisions in the face of changing conditions and helps businesses to make better decisions while mitigating risk. With the right strategies and resources, businesses can optimize their investments in order to maximize returns and minimize losses. This provides a great opportunity for businesses to take advantage of the opportunities presented by the ever-changing business environment.