Globalization In The World Of Finance An Analytical History

Globalization In The World Of Finance An Analytical History is an in-depth exploration of the history and development of the global financial system and the role of finance in global economic growth. This book examines the history and evolution of major financial instruments, from the early 1800s to the present day, and the implications of these instruments for the global economy. It explores the emergence of global financial institutions and the role of governments in the regulation of global finance. In addition, the book looks at the impact of globalization on the financial sector, including the emergence of new types of financial instruments and the growth of derivatives. Finally, the book examines the implications of the current global financial crisis for the global financial system. Through its detailed analysis, Globalization In The World Of Finance An Analytical History provides an insightful and comprehensive look at the history, development, and current state of global finance.

Defining Globalization in the World of Finance

Globalization is a complex concept that can be defined in many ways. Generally speaking, it is a process by which economic, cultural, and political systems become intertwined and interdependent on a global scale. In the world of finance, globalization has been a key factor in the increased interconnectedness of economies and markets throughout the world. It has enabled businesses to access new markets, create new opportunities, and expand their operations. Globalization has also led to increased competition in the financial industry, and the emergence of global financial institutions. The globalization of finance has had a profound effect on the world economy, and has had both positive and negative impacts on the global financial system.

This article will explore the history of globalization in finance, its current state, and the future of the process. It will analyze the effects of globalization on the global financial system, discuss the various models of international finance, and examine the impact of technology on the globalization of finance. It will also look at the role of governments, international organizations, and financial institutions in the globalization process. Finally, it will examine the implications of globalization on the future of finance.

Globalization of Financial Markets

In the modern world, the globalization of financial markets is an undeniable reality. As the world becomes increasingly interconnected, financial markets have become increasingly intertwined. This has resulted in a more fluid, interconnected global economy, and has enabled investors to access opportunities in far-flung corners of the world. This article will provide an analytical history of the globalization of finance and its implications for investors.

We will explore the various aspects of globalization in finance, including the emergence of global capital markets, the liberalization of foreign exchange and foreign investment, the growth of financial derivatives, and the increasing importance of technology. We will also examine the challenges that global finance presents, such as increased volatility, greater systemic risk, and the need for tighter regulatory oversight.

Finally, we will look at the future of finance and how the global economy is likely to be shaped by the globalization of financial markets. In doing so, we will consider how investors can best position themselves for success in this ever-changing landscape. By understanding the past, present, and future of global finance, investors can make more informed decisions about their investments and gain a better understanding of the global economy.

Globalization and its Impact on Financial Institutions

Globalization has had a major impact on the world of finance since its inception. Financial institutions across the globe have had to adapt to this new environment and develop strategies to make the most of the opportunities it presents. This article will examine the effects of globalization on financial institutions, including how it has changed the way they operate, the new technologies employed, and how it has impacted the global economy.

The increased integration of the global financial system has enabled financial institutions to access capital more easily and expand their business operations to new markets. This greater access to capital has enabled them to offer more competitive products and services, as well as to take advantage of new opportunities in emerging markets. Additionally, financial institutions are now able to take on more risk, as there are fewer restrictions on doing business in different countries.

Technology has also transformed the way financial institutions operate. Financial technology (fintech) has enabled financial institutions to automate many of their processes and reduce costs. This has enabled them to provide better customer service and faster financial services. Additionally, the use of big data and artificial intelligence has allowed financial institutions to better understand customer needs and develop new products and services to match them.

Finally, the increasing globalization of the financial sector has allowed for more efficient and effective risk management. Financial institutions have been able to diversify their portfolios and invest in new markets, while also having access to new sources of capital. This has helped to reduce the amount of risk they are exposed to and has resulted in improved stability for the global economy.

In conclusion, globalization has had a significant impact on financial institutions. It has enabled them to access capital more easily, utilize new technologies, and manage their risk more effectively. As a result, the global economy has become more stable and efficient, creating a more prosperous environment for financial institutions and their customers alike.

:max_bytes(150000):strip_icc()/globalization-7a32d360eee84693ae791eb15d0b2620.png)

The History of Globalization in the Financial World

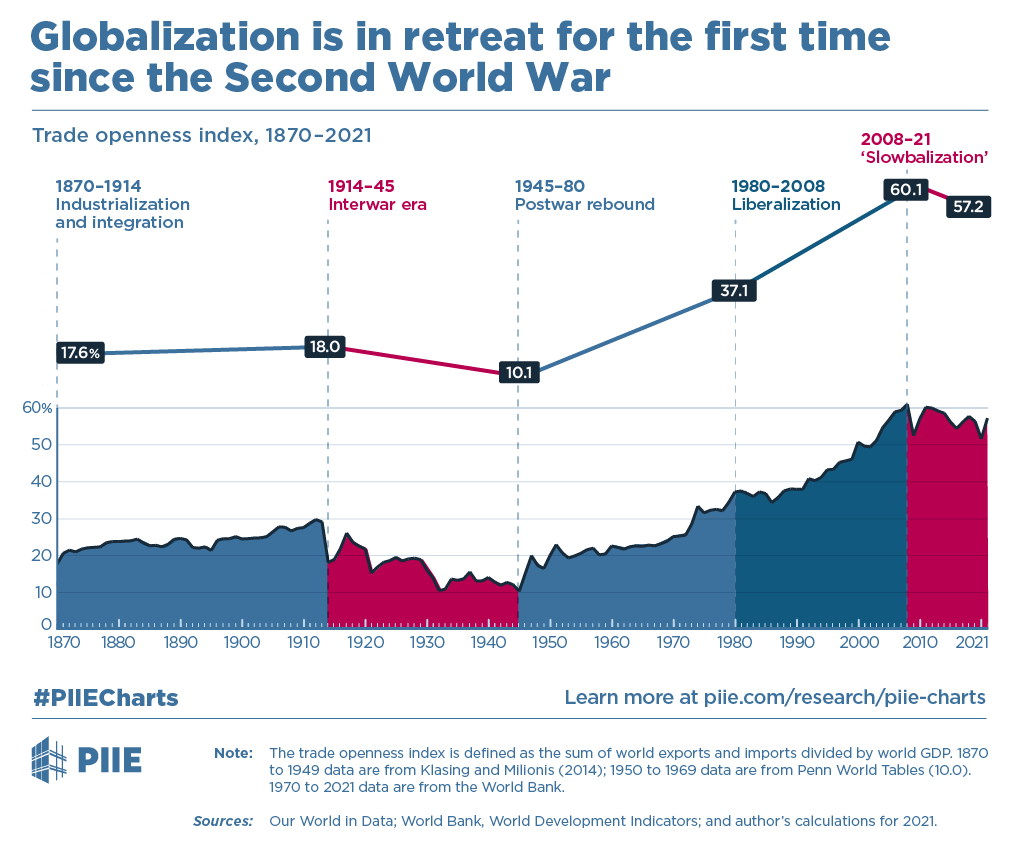

Globalization in the financial world has drastically changed the landscape of the global economy. From the mid-20th century, globalization has been a major driver of economic growth and development. In the wake of the 2008 financial crisis, global finance has become increasingly interconnected, allowing investors to access new markets, take greater risk, and generate higher returns. This article will provide an analytical history of globalization in the world of finance. We will look at the history of globalization in the financial world, from the 1950s to present day, and explore the factors behind its growth. We will examine the impact of globalization on the global financial system, including changes in financial services, the emergence of new markets, and the increasing importance of international trade. We will also discuss the various challenges of financial globalization, such as the increased risk of contagion, the rise of financial protectionism, and the need for global financial regulation. Finally, we will explore the potential benefits of financial globalization, including its ability to reduce poverty, increase economic growth, and generate greater financial stability.

Effects of Globalization on International Financial Regulations

Globalization has had a huge impact on the world of finance and international financial regulations. In recent decades, globalization has increased the speed and volume of financial transactions, making it easier for businesses to access global capital markets. As a result, there has been an increase in the number of financial regulations and standards that must be met in order to ensure that the global financial system is secure and stable. On the one hand, these regulations have made the global financial system more secure and efficient, but on the other hand, they have created a complex web of compliance requirements that can be difficult to navigate.

The global financial system is now more interconnected than ever before, and this has allowed for a greater level of transparency and oversight. International financial regulations have been put in place to ensure that the global financial system is safe and secure, and that financial institutions are held to the same standards regardless of their geographic location. This has helped to reduce the risk of fraud and corruption, and has made it easier for investors to trust their money to the global financial system.

In addition, international financial regulations have also helped to make the global financial system more efficient. By standardizing the way that financial transactions are conducted, and by introducing technology that can process large amounts of data quickly, international financial regulations have helped to reduce the cost of doing business and to make it easier for businesses to access global capital markets.

Overall, globalization has had a profound effect on the world of finance, and international financial regulations have played an important role in ensuring that the global financial system is secure and efficient. By providing oversight and standardizing the way that financial transactions are conducted, international financial regulations have helped to make the global financial system more secure and efficient.

Looking Ahead: Future of Globalization in Financial Markets

The world of finance is rapidly evolving, and globalization has been at the forefront of this shift. Globalization has transformed financial markets and the way businesses and investors approach investments. With the increased interconnectedness of economies and financial markets, the future of globalization is expected to be even more impactful in the coming years.

In order to better understand the implications of globalization on financial markets, it is important to analyze the various aspects of the phenomena. From the impact of technology, to the changes in international trade, to the emergence of new financial instruments, the impact of globalization is far-reaching and complex. Additionally, the integration of new financial markets, the rise of digital currencies, and the ability to trade across borders are all expected to reach new heights in the near future.

The future of financial markets is expected to be heavily influenced by globalization. With the increased interconnectivity of economies, the emergence of new technologies, and the ability to invest and trade across borders, financial markets are becoming increasingly intertwined. In order to be successful in this highly competitive landscape, investors and businesses must understand the implications of globalization and be prepared to capitalize on the opportunities that it brings. Furthermore, investors must remain aware of potential risks associated with globalization in order to protect their investments. As globalization continues to shape the world of finance, it is important to be aware of its potential implications and take advantage of the opportunities that it brings.

FAQs About the Globalization In The World Of Finance An Analytical History

1. What is the history of globalization in the world of finance?

Answer: Globalization in the world of finance has a long history. It began in the 19th century with the development of international stock markets and the growth of multinational companies. This trend accelerated in the 20th century with the emergence of global investment banks, the rise of electronic trading, and the growth of global capital markets.

2. How does globalization affect the world of finance?

Answer: Globalization has significantly impacted the world of finance. It has increased competition among firms, lowered the cost of capital, and made it easier for companies to access capital from around the world. It has also made it easier for investors to diversify their portfolios and access a wider range of investment opportunities.

3. How can I learn more about globalization in the world of finance?

Answer: There are a variety of resources available to help people learn more about globalization in the world of finance. Books such as “Globalization in the World of Finance: An Analytical History” provide an in-depth look at the history and impact of globalization in the world of finance. There are also many online resources available that provide news and information about the current state of the global financial market.

Conclusion

In conclusion, Globalization in the World of Finance has had a significant and far-reaching impact on the world’s financial systems. By removing barriers to international trade, allowing for increased investment flows, and allowing for the sharing of information, globalization has allowed for greater economic growth and increased prosperity. Through the use of technology, globalization has allowed for more efficient and cost-effective ways of transferring capital, reducing transaction costs, and increasing access to financial services. Despite the risks of globalization, the overall benefits to the world economy have been greater than the risks, and have allowed for increased opportunities for economic growth and development.